The World of Air Transport in 2016

According to ICAO’s preliminary compilation of annual global statistics, the total number of passengers carried on scheduled services rose to 3.8 billion in 2016, which is 6.8 per cent higher than the previous year, while the number of departures reached 35.4 million in 2016, a 3.7 per cent increase compared to 2015. Detailed information can be viewed on the Presentation of 2016 Air Transport Statistical Results page.

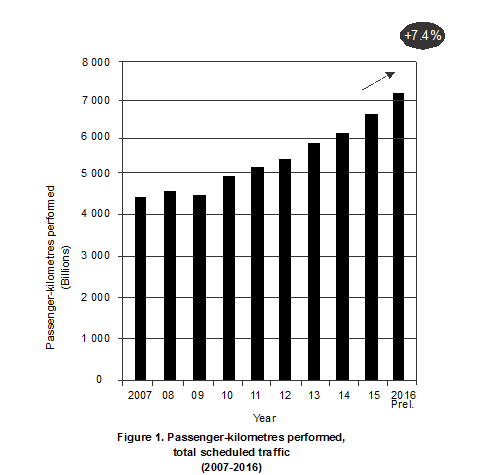

Passenger traffic, expressed in terms of total scheduled revenue passenger-kilometres performed (RPKs), posted an increase of 7.4 per cent, with approximately 7 124 billion RPKs performed in 2016. Asia/Pacific remained the largest region with 33 per cent of world traffic, posting 10.2 per cent growth in 2016, followed by Europe with 27 per cent of world traffic and growth of 6.2 per cent. North America, which accounts for 24 per cent of world traffic, grew at 4.3 per cent. The Middle East region, representing 9 per cent of world traffic, recorded a growth rate of 11.2 per cent. The Latin America and the Caribbean region accounted for 5 per cent of world traffic and grew at 4.4 per cent. The remaining 2 per cent of world traffic was undertaken by African region airlines, who recorded growth of 6.9 per cent.

More comprehensive air transport data are available at ICAO Data+ .

International scheduled passenger traffic grew by 7.8 per cent in RPKs in 2016, compared to the 7.5 per cent growth recorded in 2015. The main drivers of this growth were the carriers of China (which saw its international RPKs increase by 26.4 per cent), Qatar (27.0 per cent increase), Republic of Korea (9.7 per cent increase) and the United Arab Emirates (8.0 per cent increase). European air carriers saw growth of 6.5 per cent and accounted for the largest share of international RPKs, at 37 per cent of the total.

Asia/Pacific retained the second largest share at 29 per cent. The growth for this region was 9.5 per cent. The Middle East, which had overtaken North America as the third largest region in 2015, accounted for 14 per cent of international RPKs and recorded a growth of 11.8 per cent in 2016. North America, which accounts for a share of 13 per cent of international RPKs, grew by 3.6 per cent. African carriers, which account for 3 per cent of international RPKs, grew by 7.3 per cent, compared to a decline of 0.2 per cent in 2015. Carriers of Latin America and the Caribbean, which account for a share of 4 per cent of international RPKs, experienced the largest decline in growth, from 11.0 per cent in 2015 to 7.0 per cent in 2016.

Domestic scheduled passenger traffic grew by 6.7 per cent in RPKs in 2016, down from the 7.6 per cent growth recorded in 2015. The main drivers of this growth were the carriers of the United States, China and India, which saw increased growth by 4.6, 11.8 and 23.4 per cent, respectively. North America, the world’s largest domestic market with a 42 per cent share of domestic RPKs, experienced 4.6 per cent growth in 2016, compared to 5.9 per cent growth seen in 2015. The Asia/Pacific region, with a share of 40 per cent, also grew strongly by 11.0 per cent in 2016 (9.9 per cent in 2015). Carriers of Europe, accounting for 9 per cent of domestic RPKs, saw growth of 4.2 per cent in 2016, compared to 7.3 per cent in 2015. The Latin America and the Caribbean region, which accounts for a 7 per cent share, saw growth of 1.7 per cent in 2016 compared to the 7.1 per cent growth seen in 2015. Carriers of the Middle East and Africa, which together account for 2 per cent of domestic RPKs, saw a decline of 1.1 per cent and growth of 4.3 per cent, respectively.

Low-cost carriers carried an estimated 1.1 billion passengers in 2016, which was approximately 29 per cent of the world total scheduled passengers. This indicated a 10.5 per cent growth when compared to the number of passengers carried by low-cost carriers in 2015, one and a half times the rate of the world total average passenger growth.

In 2016, economic growth in the United States, China, India, Japan, and the High Income Euro Area continued to support passenger demand, offsetting overall economic weakness and slowing growth. The annual average price of jet fuel was 19 per cent lower in 2016 than it was in 2015, giving air carriers significant flexibility to adjust air fares and help stimulate or retain the momentum in passenger traffic growth. In addition, the introduction of new direct routes and additional frequencies between China and the United States, Spain and the United Kingdom, Qatar and the United States, and Intra-Asia routes, also stimulated additional passenger demand.

Capacity offered by the world’s airlines, expressed as available seat-kilometres, increased globally by 7.4 per cent in 2016. The capacity growth ranged from 2.9 per cent in Latin America and the Caribbean to 13.2 per cent in the Middle East. The average 2016 global passenger load factor at 80.3 per cent was similar to that of the previous year, and ranged from 68.5 per cent for Africa to 83.3 per cent for North America. While load factors across regions remained in line with that of the previous year, notable exceptions were the air carriers of the Middle East and North America, which saw a decline in the load factors by 1.3 and 0.4 percentage points, respectively.

Approximately 53 million tonnes of freight were carried in 2016. Growth of scheduled total freight traffic, expressed in terms of scheduled total freight tonne-kilometres performed (FTKs), was at 3.8 per cent in 2016, up from the 1.3 per cent recorded in 2015. This growth was mainly due to the strong second half of 2016 for air freight pointing to improving trade activity in 2017. Middle East carriers recorded a growth of 7.2 per cent, followed by Europe with 5.7 per cent, Asia/Pacific with 2.9 per cent, Africa with 2.8 per cent, and North America with 2.1 per cent. Carriers of Latin America and the Caribbean saw their growth rates contract by 1.9 per cent compared to the previous year.

Scheduled international FTKs posted an increase of 3.7 per cent in 2016, compared to the 1.4 per cent growth of 2015. International air freight represented around 86 per cent of total scheduled FTKs. Air carriers in Asia/Pacific carried nearly 40 per cent of scheduled international FTKs; the figure was 26 per cent for carriers in Europe, 16 per cent for the Middle East, and 13 per cent for those in North America. This indicated that nearly 80 per cent of long-haul freight traffic flowed on the East-West trade lane that connects Asia to Europe, Asia to North America, and Europe to North America.

Scheduled international freight capacity in 2016, expressed in available freight tonne-kilometres, was approximately 333 billion, a 4.7 per cent growth compared to 2015. The scheduled international freight load factor declined from 53.5 per cent in 2015 to 53.0 per cent in 2016. A combination of sluggish trade, overcapacity, and a rapid shift to e commerce, coupled with competition from other cheaper modes of freight transport, continued to be net negatives for air freight in 2016.

In 2016, the operating profit of scheduled airlines of Member States was estimated at about 9.2 per cent of operating revenues. The operating profit was expected to be around USD 65 billion in 2016 based on operating revenues of USD 709 billion. Nearly 52 per cent of the operating profits came from the performance of air carriers in North America, followed by carriers of Asia/Pacific and Europe with 25 and 19 per cent, respectively. The aforementioned drop in fuel price contributed very significantly to improving profitability for the industry. A detailed variance analysis of changes in operating profits appears in the Presentation of 2016 Air Transport Statistical Results, Table 9.

After 2.4 per cent growth in real Gross Domestic Product (GDP) in 2016, the World Bank has forecasted 2.7 per cent GDP growth for 2017. Accordingly, ICAO has forecasted that total passenger traffic will grow by about 7.6 per cent in 2017. The operating profit for the industry is expected to be around USD 57 billion in 2017 due to the combined effects of improving economic growth and low and stable jet fuel prices.

According to the latest ICAO long-term air traffic forecasts, the 3.8 billion airline passengers carried in 2016 are expected to grow to about 10.0 billion by 2040, and the number of departures is projected to rise to some 95 million in 2040.

With regard to aircraft, the world’s major manufacturers delivered 1 520 new commercial aircraft in 2016 and recorded 1 555 new aircraft net orders. Book-to-bill ratios for two of the largest aircraft manufacturers declined from around 1.3:1 in 2015 to around 1:1 in 2016, providing an indicator of slowing pace of aircraft orders. While the declining price of jet fuel could dampen near term demand for new aircraft, traffic growth projections, low to stable borrowing costs, improving airline profitability, growth of low cost carriers and the fleet replacement programmes of carriers are expected to maintain the strength of the aircraft market.

As for aviation safety, there were 79 aircraft accidents for scheduled air services in 2016, a decrease of 14 per cent from 2015, when 92 accidents were reported. This is according to an analysis of global safety data involving commercial air transport aircraft with a maximum certificated take-off mass of more than 5 700 kilograms. The number of fatalities in scheduled operations worldwide decreased to 183 fatalities, from 474 in 2015. The number of fatal accidents increased from 6 in 2015 to 8. The global accident rate decreased to 2.3 accidents per million schedule departures versus 2.8 accidents per million scheduled departures in 2015.

During 2016, the ICAO Secretariat recorded 9 acts of unlawful interference. These included 2 sabotages, 2 unlawful seizures and 5 facility attacks. Details concerning all 2016 events are available in the Acts of Unlawful Interference Database, which is accessible through ICAO’s secure website.